You Scaled Before You Knew Where You Win

Why most B2B GTM systems break after Series A, and how premature scale turns learning into long-term drag

TL;DR

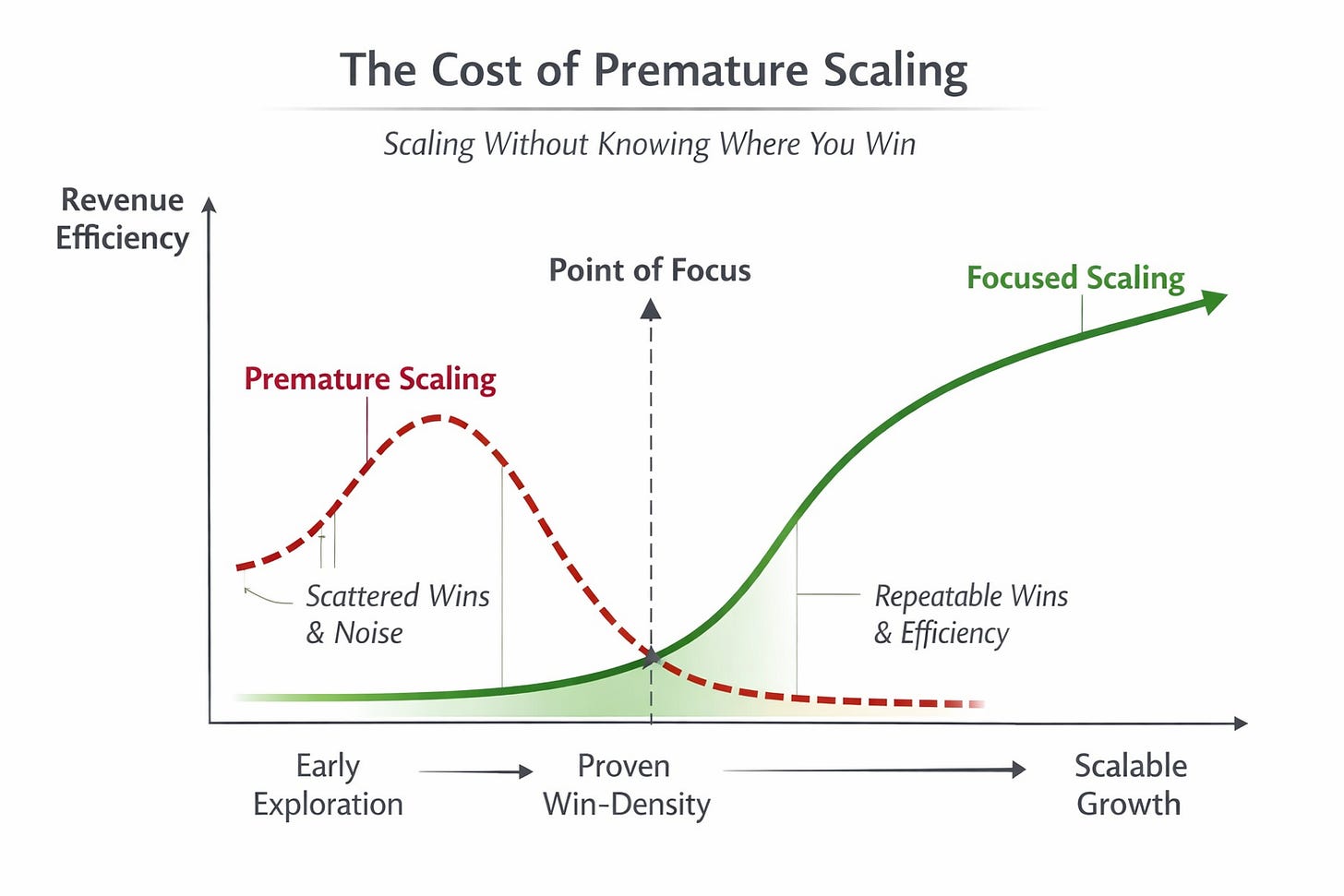

Most B2B teams don’t fail because they pick the wrong market. They fail because they scale go-to-market before they know where they actually win. The mistake is made at seed, when exploration quietly becomes permanent, and the cost shows up after Series A, when systems, automation, and eventually AI agents begin compounding ambiguity instead of clarity. Scale doesn’t create truth. It amplifies whatever is already there.

For a long time, B2B growth felt deceptively simple, almost mechanical in the way teams responded to pressure: when revenue slowed, coverage expanded; when pipeline dipped, markets widened; when one segment stalled, two more were added, and the math appeared to work because the environment forgave inefficiency long enough for momentum to hide the cost.

That world no longer exists, and what has replaced it is not a sudden disappearance of demand but a quieter, more uncomfortable realization that many teams are only now beginning to articulate: we are investing dramatically more to grow materially less, not because buyers changed, but because we scaled before we understood where our success was actually repeatable.

This is not a market-sizing problem. It is a sequencing problem.

The Mistake Is Made at Seed

Why exploration quietly turns into permanent indecision

Most B2B leaders do not make this mistake when they are large, operationally complex, or already burdened by layers of process; they make it much earlier, when expansion still feels indistinguishable from learning and saying yes feels like progress rather than risk.

At the seed stage, exploration is rational and necessary. Founders are encouraged to chase signal wherever it appears, inbound leads are treated as data, adjacent segments feel worth testing, and optionality is rewarded because the goal is discovery, not efficiency.

The mistake is not exploration. The mistake is never exiting exploration mode.

By the time a company reaches Series A, the question is no longer what could work but what has already proven to work consistently, and that is the moment when go-to-market should contract before it scales. Most companies do the opposite, carrying forward every experiment that did not fail outright, treating partial wins as validation, and beginning to build systems that assume breadth rather than density, quietly locking in a cost structure that reflects uncertainty rather than confidence.

Scale Does Not Create Clarity

It magnifies whatever is already there

There is a deeply ingrained belief in modern B2B teams that scaling coverage is how clarity emerges, that more accounts produce more data, more reps create faster learning loops, and more segments provide insurance if any single path underperforms.

The logic sounds disciplined, even prudent, but it breaks under real operating conditions because scale does not create truth; it magnifies patterns, and when those patterns are uneven, situational, or dependent on individual heroics, scale turns them into institutional drag.

What scale actually requires before it creates leverage is something far less glamorous and far more constraining: win-density.

What Scale Actually Needs

Why win-density matters more than coverage

Win-density is the phase where success stops feeling impressive and starts feeling boring, where deals close for similar reasons, sales cycles compress without force, discounting stabilizes, customers adopt without being dragged, retention feels like gravity rather than persuasion, and expansion happens without re-selling the product from scratch.

You stop celebrating individual wins because outcomes begin to feel inevitable.

Most companies experience this briefly, early on, then move past it too quickly, mistaking early validation for structural readiness and scaling motion before they scale certainty, which is where efficiency quietly begins to leak.

When Systems Fail, They Fail Politely

How misalignment hides in plain sight

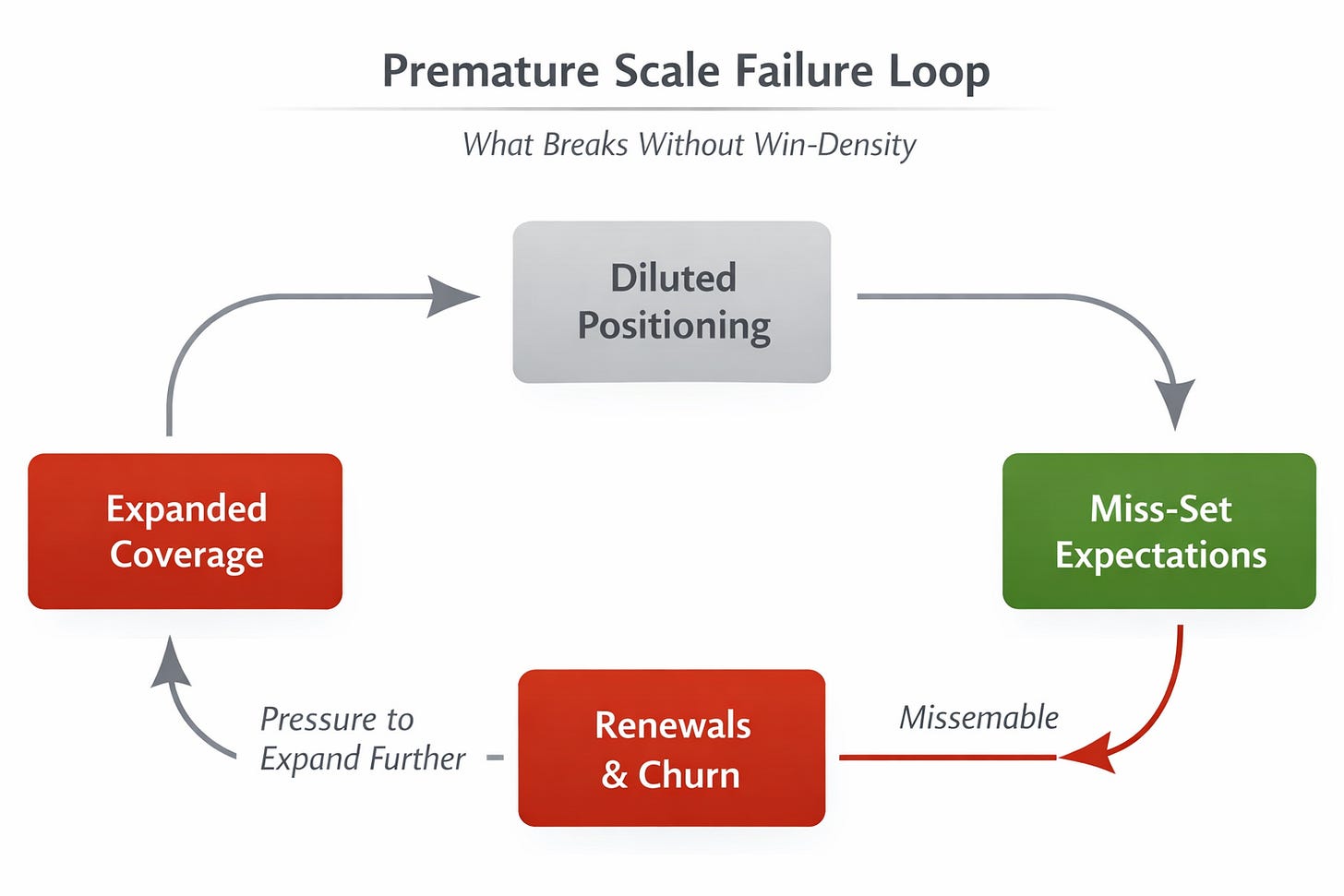

When win-density is missing, go-to-market systems do not fail loudly or dramatically; they fail politely.

Coverage expands into segments that look reasonable but lack urgency, forcing sellers to work harder just to remain relevant while qualification softens and exceptions quietly become normal. Positioning stretches to accommodate variance, turning what was once sharp into something flexible enough to fit many buyers but resonant with none, until leadership finds itself endlessly discussing the need to simplify the value proposition without confronting the underlying cause. Downstream, revenue quality degrades as sales compensates for low-density segments by reshaping the promise, creating a widening gap between what was sold and what can actually be delivered, which customer success is left to reconcile long after the deal is booked.

Nothing appears broken in isolation. Together, the system becomes expensive to operate and fragile to scale.

Nothing Broke

The system just stopped forgiving uncertainty

For a while, the system still holds.

Revenue grows, headcount expands, new tooling gets layered in, and leaders tell themselves inefficiency is temporary, that systems will fix it once things stabilize. But systems do not create focus; they encode it. When CRM workflows, routing logic, compensation plans, forecasting models, and automation are built on top of an undefined win core, the organization is not preparing to scale, it is cementing ambiguity, and from that moment on, every dollar of growth is taxed by a decision the company no longer remembers making.

This is why growth often feels healthy through early Series A, only to slow sharply as Series B expectations arrive. Nothing breaks. The system simply stops forgiving uncertainty.

Seed Is for Learning

Series A is for choosing

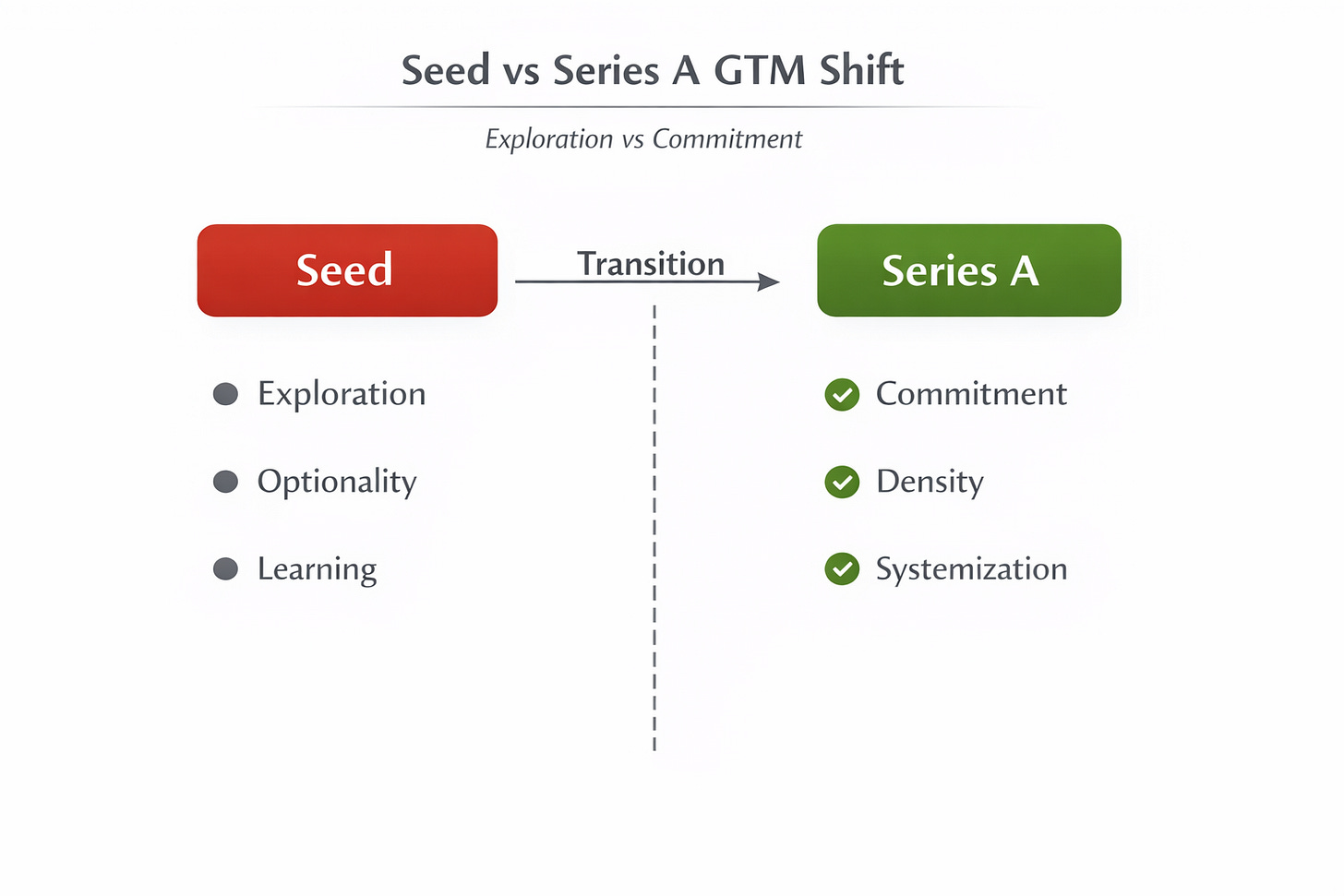

The cleanest way to understand this transition is simple: seed is where you explore the market, and Series A is where you choose it.

That choice is not about TAM; it is about where wins have become boring, which customers buy quickly without persuasion, which use cases activate without intervention, and which segments retain without negotiation. If those answers are not explicit by the time go-to-market systems are implemented, scale becomes expensive by default.

Why This Gets Dangerous With Agents

When automation amplifies ambiguity

This sequencing error becomes existential as teams move toward agentic GTM.

AI agents do not struggle with ambiguity; they execute it efficiently, which means that if your system lacks a clear definition of where it wins, agents will simply scale misalignment faster, automating outreach, qualification, and follow-up across segments that were never high-probability to begin with. This is why so many early agentic GTM efforts feel noisy instead of leveraged: agents are not a shortcut to clarity, they are a force multiplier on whatever system already exists, and without win-density and explicit orchestration, agentic GTM does not fix inefficiency, it industrializes it.

The Decision Most Teams Avoid

And why delaying it makes everything harder later

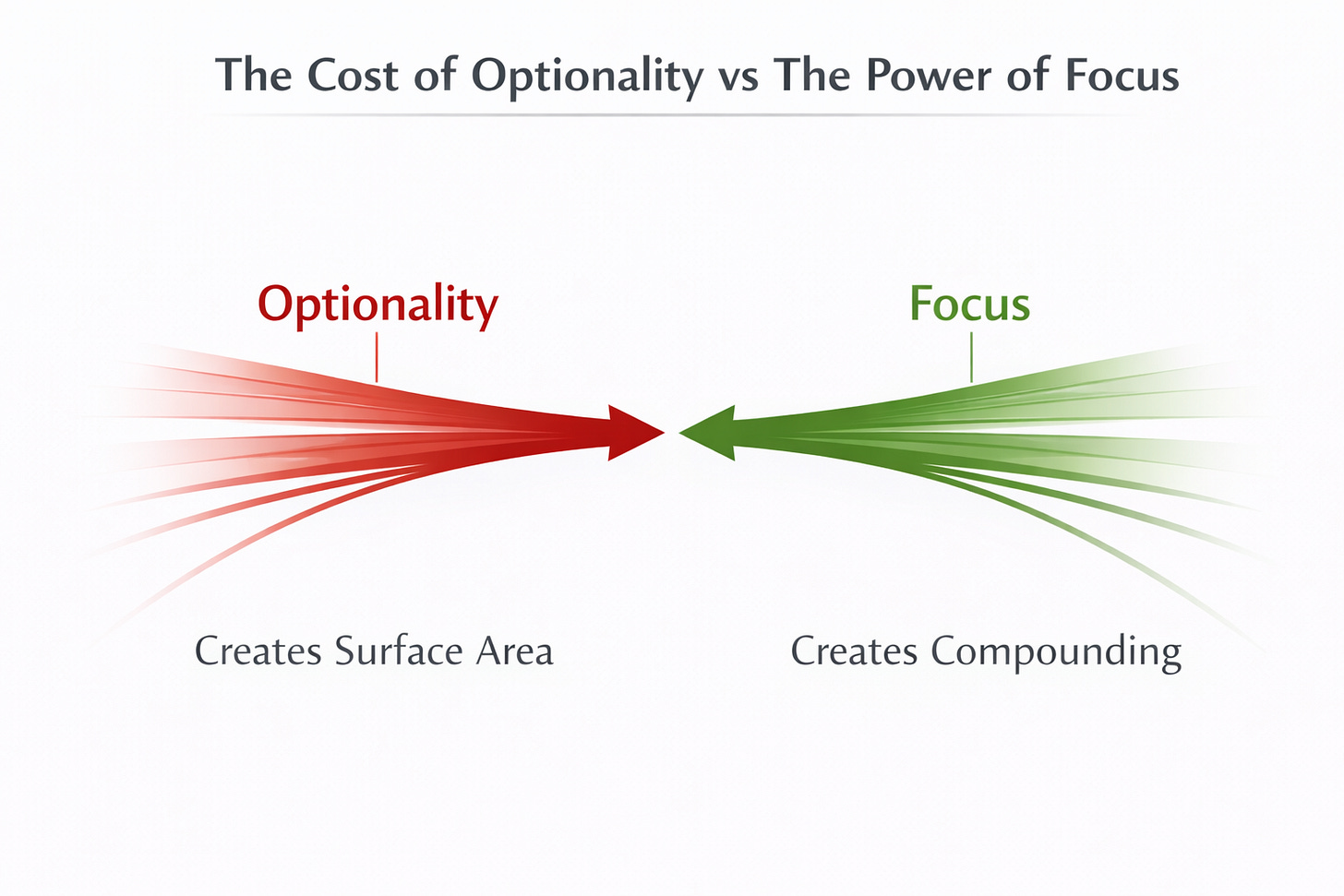

The most important go-to-market decision in a B2B company’s life is not when it raises Series A or hires its first VP of Sales; it is the moment leadership decides to stop exploring and start committing.

Most teams delay that decision because optionality feels safer than focus, but in reality, focus is what allows people, systems, and eventually agents to compound instead of collide. The companies that get this right often look conservative at first, turning down deals, narrowing messaging, and slowing expansion plans, only to discover that their systems get simpler instead of heavier, their agents get quieter instead of noisier, and their growth becomes predictable instead of volatile.

The New Advantage

Knowing where you win before you scale it

The next era of B2B growth will not reward surface area. It will reward teams that know, with uncomfortable clarity, where they win, and are disciplined enough to let scale amplify only that truth.

Scaling before you know where you win does not make you bold. It makes you expensive, and once the system is built, that cost compounds whether you grow or not.

If you want to go one layer deeper, Agentic GTM Requires Systems, Not Smarter Agents explores what happens when automation and AI are layered onto go-to-market systems that have not yet achieved win-density.