The State of AI GTM - 2025 Edition

Three years after the AI Big Bang, the hype is over, the patterns are clear, and the winners are pulling ahead. Here’s the new GTM playbook.

The AI hype cycle has ended. What remains isn’t speculation — it’s execution. In 2025, the difference between breakout winners and stalled experiments comes down to GTM architecture: how fast you can wedge into a workflow, how defensible your moats are, and how deeply your product embeds into daily operations. This report distills the patterns shaping the next wave of durable AI growth.

Two Winning Archetypes in AI GTM

When it comes to AI growth, founders often confuse speed with sustainability. The truth is, there are only a couple of repeatable velocity models that consistently scale.

Operator Callout: Not all AI rocket ships follow the same trajectory — your GTM strategy should match your velocity model.

Playbook Tip: For most founders, Shooting Star pacing wins — fast, but with healthy economics and defensibility.

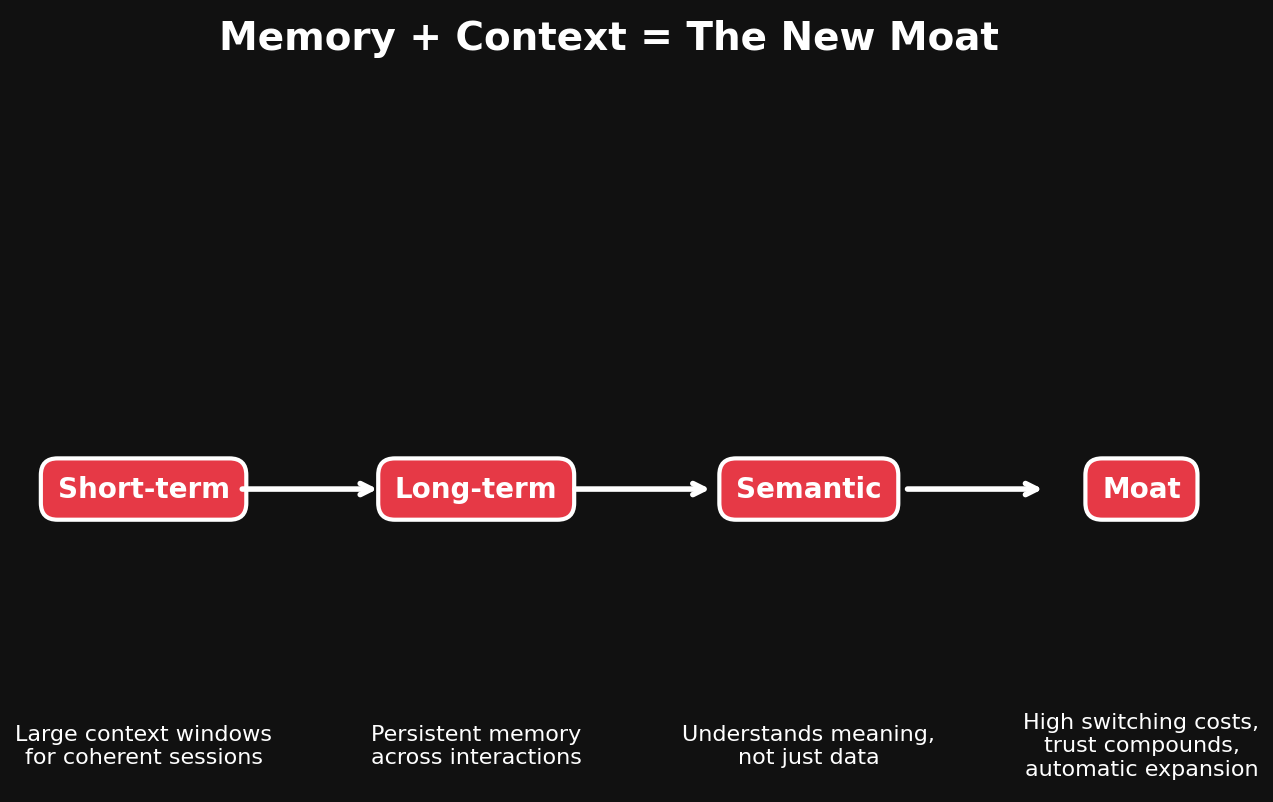

Memory + Context = The New Moat

AI-native products that remember and adapt are sticky by design. In SaaS 1.0, retention was a function of integrations and customer success. In AI 2.0, it’s about whether the product itself remembers, understands, and grows with the customer.

Operator Callout: In 2025, memory is the new integration layer. Products that can carry forward customer context don’t just retain — they expand automatically.

Three Levels of AI Memory:

Short-term (session memory): Large context windows allow for coherent, multi-turn sessions — but without persistence, every new login feels like amnesia.

Long-term (persistent memory): The product recalls a user’s history, preferences, and workflows across sessions. This enables personalization that compounds over time.

Semantic (understanding memory): Going beyond storing data, the product actually understands meaning — surfacing insights, anticipating next steps, and adapting to changes.

Why This Is a Moat:

Switching costs rise the longer a product “knows” a customer’s world. Moving to a competitor means retraining from scratch.

Trust compounds — when users feel “seen” by the product, they stick, even if competitors have cheaper features.

Expansion accelerates — memory unlocks upsells (“since you do X, let me help with Y”) without heavy sales touch.

Playbook Tip: Make retention a product feature, not just a CSM function. If your product knows the customer’s world better than they do, churn becomes unthinkable.

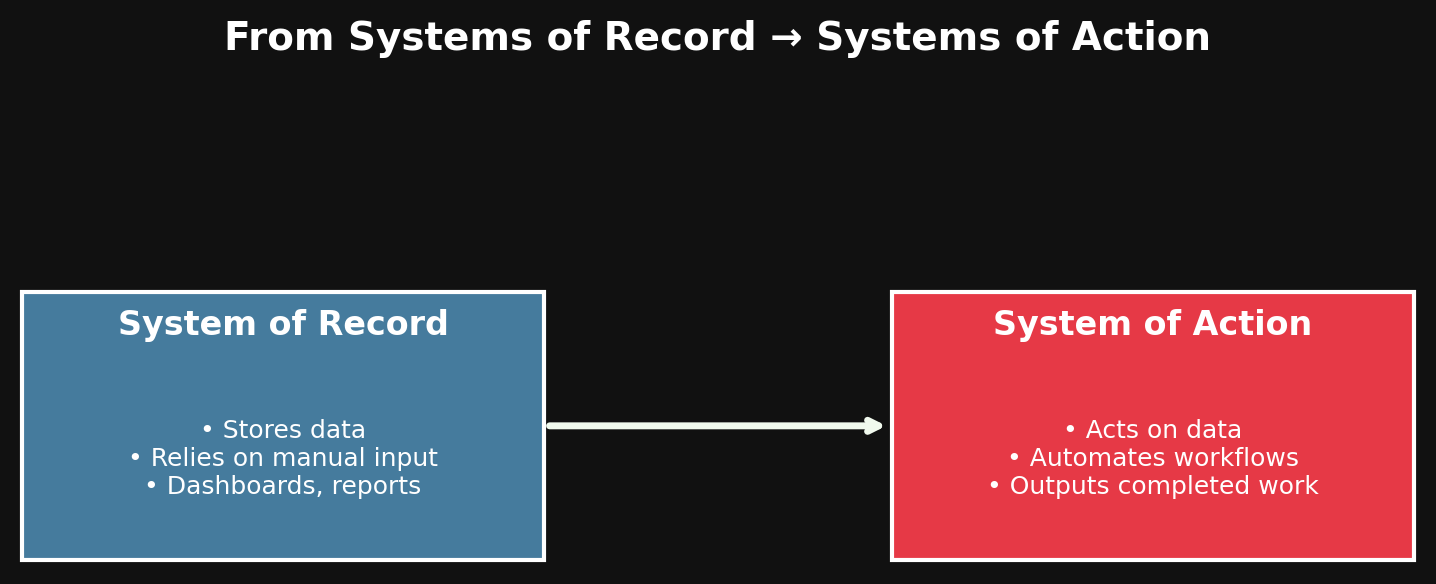

From Systems of Record → Systems of Action

Traditional SaaS was built as systems of record: places where data was stored, tagged, and occasionally queried. The new frontier is systems of action: platforms that don’t just record activity, but perform it

Operator Callout: The biggest SaaS categories are no longer safe. If your GTM strategy relies on “integrating with Salesforce,” you may wake up to a world where Salesforce itself is a background database, not the workflow hub.

What’s Changing:

Legacy SaaS is exposed — CRM, ERP, and HRIS tools were built for manual inputs and dashboards. They rely on people to act.

AI-native challengers act directly on data — drafting the email, updating the forecast, scheduling the meeting — without a human moving between tools.

Agentic workflows = 10x ROI — instead of incremental efficiency gains (2–5%), you get step-changes (90% of a workflow automated end-to-end).

Playbook Tip: Don’t retrofit AI into old workflows. Rebuild so the output is the work. The winning AI products won’t ask for inputs — they’ll deliver results.

And just as systems of action redefine workflows, the sharpest AI companies are entering markets through a single wedge that unlocks expansion.

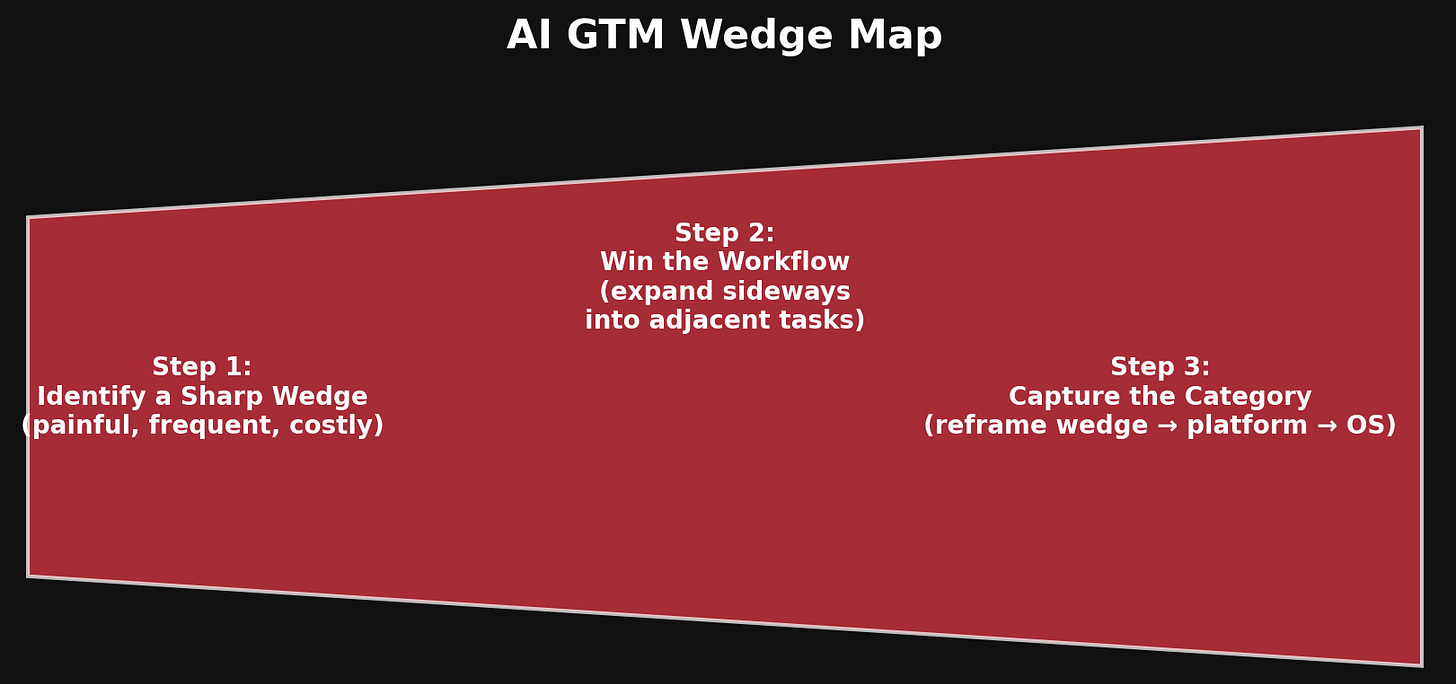

The AI GTM Wedge Play

Every breakout AI company of the past three years has started with a sharp wedge — a painful, frequent, high-value problem that nobody else solved well. The wedge gets you in the door, but it’s only the beginning. The winners expand sideways into the workflow, and eventually capture the category.

Operator Callout: Too many founders pick a wedge that’s interesting to them but not economically sharp enough. If customers don’t feel the pain every day, it’s not a wedge — it’s a feature.

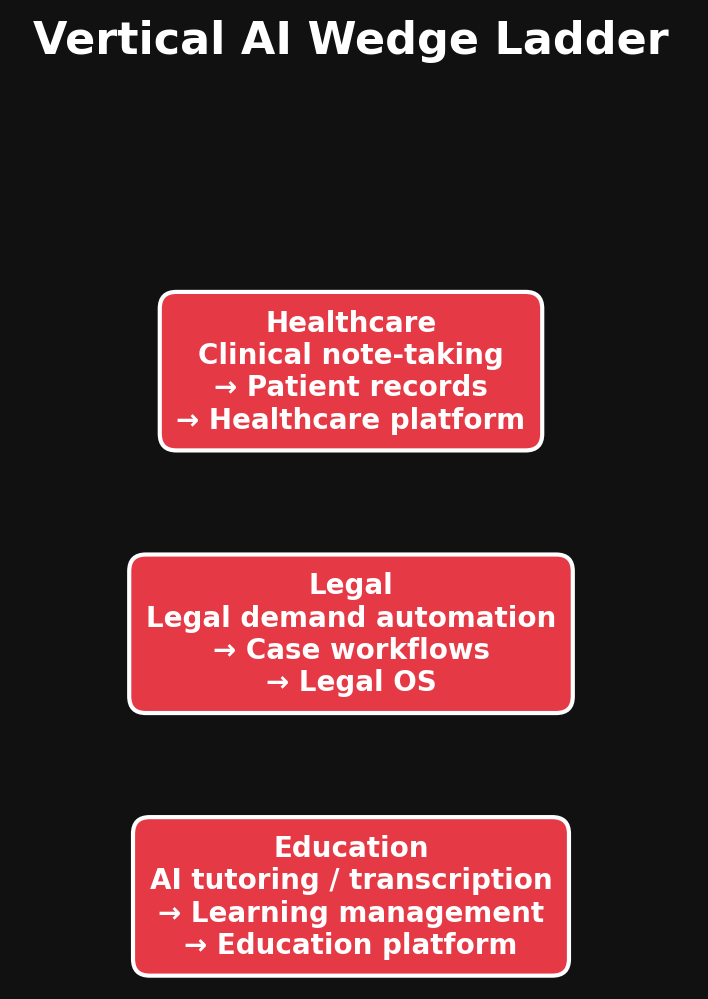

Examples of the Wedge → Workflow → Category Path:

Legal demand automation → case preparation → full legal OS

Clinical note-taking → patient record integration → healthcare platform

AI sales notes → pipeline management → AI CRM

AI GTM Wedge Map (3 Steps)

Identify a sharp wedge

Look for problems that are expensive, frequent, and high-friction

Validate that customers already pay to solve them, even with duct-taped solutions

Win the workflow

Expand into adjacent tasks so the product becomes indispensable in daily operations

Make switching impossible by owning the full workflow, not just one step

Capture the category

Reframe the narrative from tool → platform → operating system

Build integrations and ecosystem layers to make your wedge the default hub

Playbook Tip: Solve the sharpest pain first. Use that foothold to win the workflow, then the category.

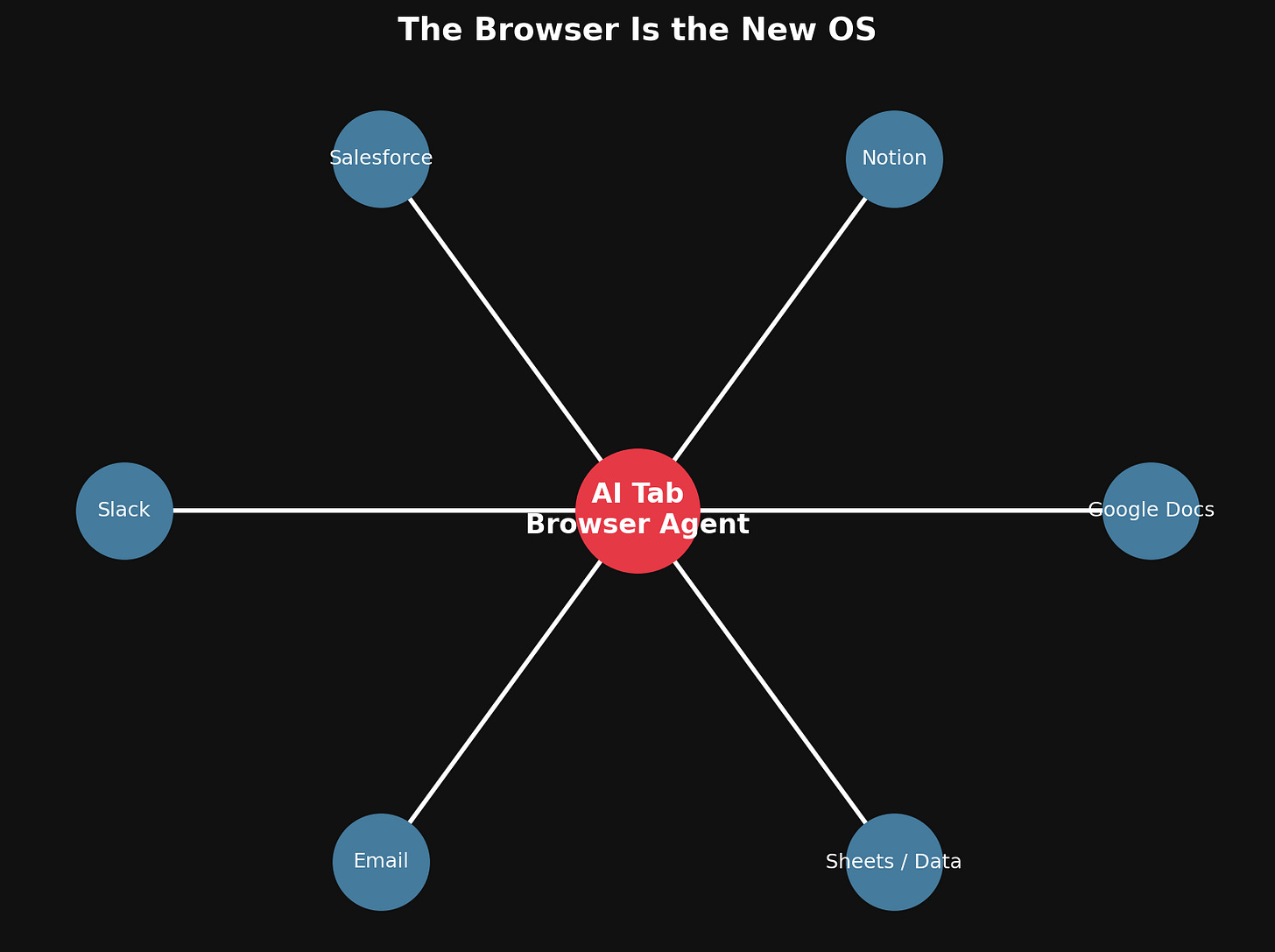

The Browser Is the New OS

Agentic browsers like Comet and Dia are turning the web into a programmable command center. Instead of being a passive window, the browser is becoming the orchestration layer where AI agents live, act, and collaborate.

Operator Callout: If your AI product requires users to constantly log in, upload data, or juggle integrations, you’re at risk. The browser layer will compress those steps into one.

Why this matters for GTM:

Distribution shifts: In a browser-native world, the entry point isn’t your app — it’s the AI tab. Whoever owns the “control center” can mediate user flows across apps, making traditional SaaS navigation obsolete.

Workflow consolidation: Tabs, extensions, and plug-ins become orchestrated tasks. A browser agent can draft the contract in Google Docs, file it in Notion, and push it into Salesforce — all without a human switching context.

Identity + memory: Because the browser sits at the intersection of apps, it naturally becomes the keeper of user state and memory. This creates the potential for horizontal moats bigger than single-app verticals.

Playbook Tip: If your AI product lives online, design for browser-native, multi-step workflows now. Think in terms of flows, not screens. The “AI tab” is your future control panel — and if you’re not in it, you’re invisible.

Private Evals = Enterprise Confidence

Leaderboard scores don’t win enterprise deals — private proof does.

Enterprise Eval Readiness Checklist:

☐ Can your product run on proprietary customer data in a sandboxed environment?

☐ Do you track latency, accuracy, and hallucination rates in real-time?

☐ Is there a clear audit trail (data lineage, compliance flags)?

☐ Can security/legal review your setup in under 30 minutes?

☐ Do you provide a simple before/after ROI snapshot?

Operator Callout: Benchmarks don’t close deals. Trust does.

Playbook Tip: Treat evals as a sales motion, not an engineering favor. Enterprise trust is earned through controlled trials, not benchmarks.

Once trust is established through private evals, the question shifts to where AI delivers the deepest ROI — and that’s where vertical focus comes into play.

Why Vertical AI Is Winning Fast

Industries long dismissed as “slow to adopt” weren’t resistant to technology — they were waiting for tools that could handle their real work. Horizontal AI tools struggle with context, compliance, and integration complexity. Vertical AI companies win by embedding deeply into domain workflows.

Where It’s Happening:

Healthcare: Clinical note-taking → patient record automation → healthcare platform

Legal: Demand automation → workflows → legal OS

Education: AI tutoring → LMS → personalized education platforms

Operator Callout: Going vertical doesn’t shrink TAM — it often expands it. By solving a domain’s hardest problems, you capture not just one workflow but the entire category stack.

Playbook Tip: Deep vertical focus can deliver a bigger TAM than chasing horizontal. Start with a wedge that screams ROI in one industry, then expand up the stack until you own the category.

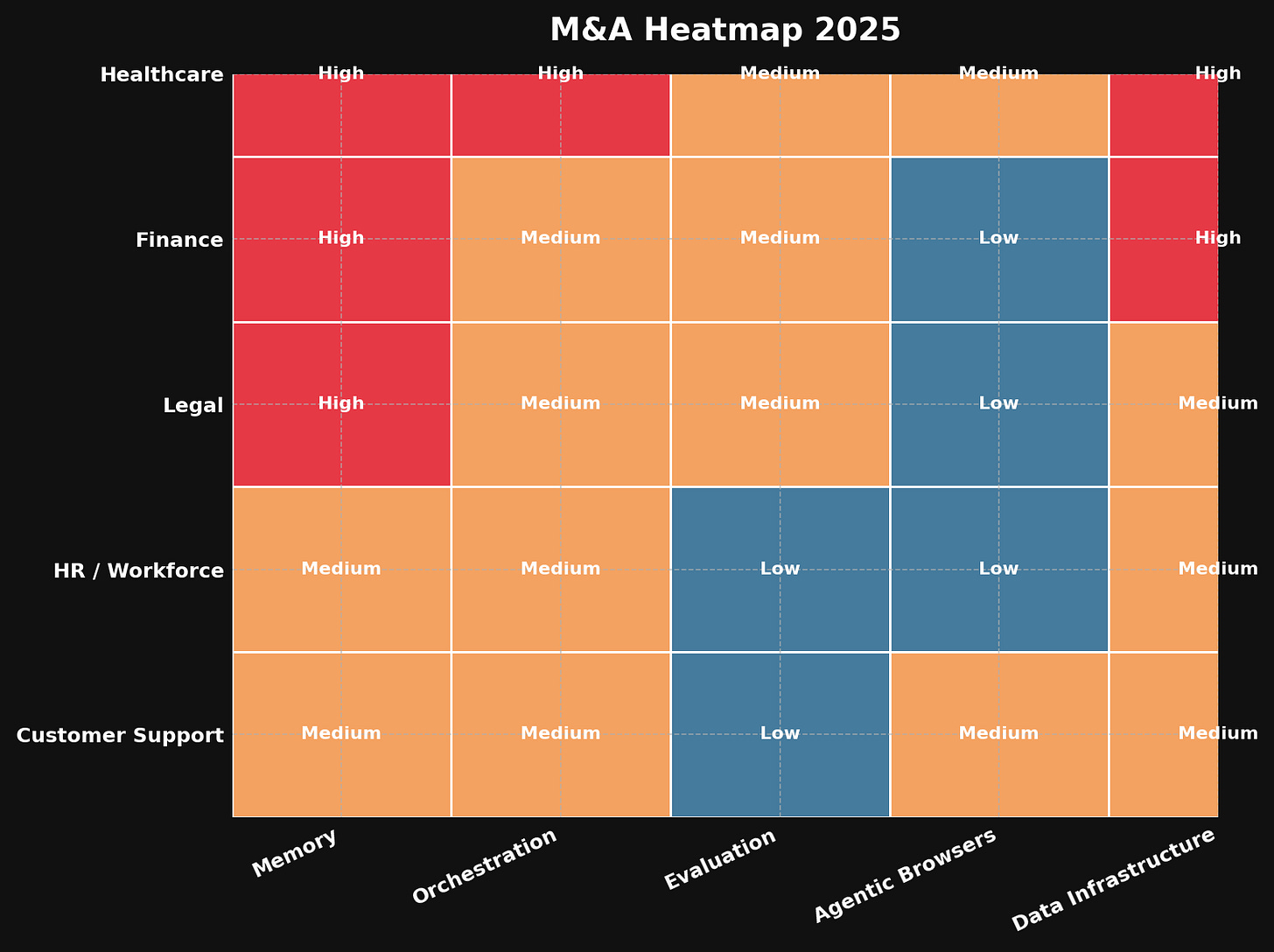

Incumbents Are Waking Up

The early “AI tooling” wave was written off by many incumbents as hype. That’s over. In 2025, Big SaaS knows the stakes — and they’re responding with their balance sheets.

Where to Expect Activity:

Regulated industries: Healthcare, finance, and legal (credibility + compliance are bought, not built).

Service-heavy verticals: HR, accounting, customer support (continuity and stickiness matter).

Infrastructure layers: Memory, orchestration, evaluation, and agentic browsers (prime M&A targets).

Operator Callout: Big SaaS isn’t standing still — they’re shopping. If your GTM looks like a feature inside Salesforce, Workday, or ServiceNow, assume you’ll either compete head-on or be on their shopping list.

Playbook Tip: Build to own the category, but engineer optionality. Strategic exits in 2025 won’t come from desperation — they’ll come from strength.

The Founder’s Edge in 2025

Speed still matters — but in 2025, speed with precision is what separates noise from durable companies.

What Top Founders Are Doing Differently:

Choosing the right wedge — painful, frequent, expensive

Building moats from day one — memory, context, data, embedding

Creating must-have workflows — products customers can’t work without

Operator Callout: Precision is the edge.

⚡ Operator’s Takeaway

The 2025 GTM frontier isn’t about chasing hype — it’s about velocity with precision. Match your archetype, own your wedge, and make retention the moat.

The era of AI GTM experiments is finished. From here on, it’s architecture.

Want to explore the broader playbook of durable advantages? Read 15 Moats That Define Modern GTM Strategy →